"Executive Summary Spain Accounts Receivable Automation Market :

The Spain Accounts Receivable Automation Market report contains market insights and analysis for industry which are backed up by SWOT analysis. This market research report acts as a great support to any size of business whether it is large, medium or small. In this report, several aspects about the market research and analysis for the industry have been underlined. The precise and state-of-the-art information provided via this report helps businesses get aware about the types of consumers, consumer’s demands and preferences, their point of view about the product, their buying intentions, their response to particular product, and their varying tastes about the specific product already existing in the market.

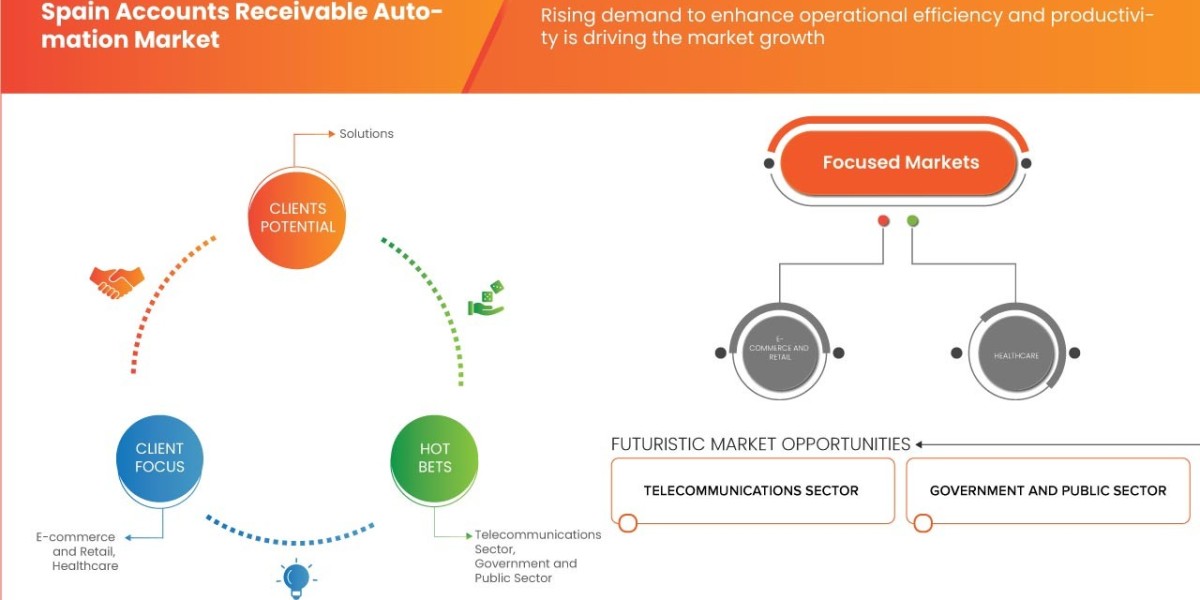

Market parameters covered in this Spain Accounts Receivable Automation Market report are latest trends, market segmentation, new market entry, industry forecasting, future directions, opportunity identification, strategic analysis and planning, target market analysis, insights and innovation. The report comprises of the market drivers and restraints which are derived from SWOT analysis and also provides all the CAGR projections for the historic year and base year and forecast period . The Spain Accounts Receivable Automation Market report takes into account all the opportunities, challenges, drivers, market structures, and competitive landscape for the patrons.

Discover the latest trends, growth opportunities, and strategic insights in our comprehensive Spain Accounts Receivable Automation Market report. Download Full Report: https://www.databridgemarketresearch.com/reports/spain-accounts-receivable-automation-market

Spain Accounts Receivable Automation Market Overview

**Segments**

- Based on component, the Spain accounts receivable automation market can be segmented into solutions and services. Solutions segment is further divided into audit management, credit management, collections management, and dispute management. The services segment includes professional services and managed services.

- By enterprise size, the market can be categorized into small and medium-sized enterprises (SMEs) and large enterprises. SMEs are expected to witness a higher growth rate as they are increasingly adopting accounts receivable automation to streamline their financial processes.

- On the basis of deployment type, the market is segmented into cloud-based and on-premises solutions. Cloud-based deployment is gaining popularity due to its scalability, flexibility, and cost-effectiveness.

**Market Players**

- Some of the key players operating in the Spain accounts receivable automation market include HighRadius Corporation, Sage Intacct, Inc., FinancialForce, Sofitto, Esker, Versapay Corporation, Bill.com, Artsyl Technologies, Inc., YayPay Inc., Efficient Forms, YayPay, Inc., and FIS.

- These market players are focusing on strategic partnerships, acquisitions, and product innovations to gain a competitive edge in the market. The increasing demand for automation in the accounts receivable process is driving these companies to enhance their offerings and expand their market presence.

Overall, the Spain accounts receivable automation market is witnessing significant growth due to the increasing need for streamlining financial operations, improving cash flow, and reducing manual errors. The adoption of advanced technologies such as artificial intelligence and machine learning is further propelling the market growth. With the presence of key players offering a wide range of solutions and services, the market is poised for substantial expansion in the coming years.

The Spain accounts receivable automation market is a dynamic landscape with various segments shaping the industry. The market segmentation based on components into solutions and services offers a comprehensive view of the offerings available to businesses in Spain. Solutions such as audit management, credit management, collections management, and dispute management cater to different aspects of accounts receivable automation, providing companies with a tailored approach to managing their financial processes. On the other hand, services like professional services and managed services ensure that businesses have the necessary support and expertise to implement and utilize automation effectively.

Moreover, the segmentation based on enterprise size into SMEs and large enterprises highlights the varying adoption rates within the market. SMEs are expected to experience significant growth in implementing accounts receivable automation, driven by the need to streamline financial operations and enhance efficiency. As these smaller companies realize the benefits of automation in improving cash flow and reducing manual errors, the demand for tailored solutions and services is set to increase.

Additionally, the deployment type segmentation between cloud-based and on-premises solutions reflects the shifting preferences towards cloud technology in the accounts receivable automation market in Spain. Cloud-based deployments offer scalability, flexibility, and cost-effectiveness, making them a popular choice among businesses looking to modernize their financial processes. The rise of cloud-based solutions indicates a broader industry trend towards leveraging digital infrastructure for improved operational agility and accessibility.

In terms of market players, the presence of key companies such as HighRadius Corporation, Sage Intacct, Inc., and FinancialForce signifies a competitive landscape focused on innovation and strategic partnerships. These market players are actively investing in research and development to enhance their solutions, stay ahead of market trends, and meet the evolving needs of customers in Spain. The market's growth is being further fueled by advancements in technologies like artificial intelligence and machine learning, which are transforming how accounts receivable automation is approached and implemented.

Overall, the Spain accounts receivable automation market presents significant opportunities for businesses seeking to optimize their financial processes and drive growth. By embracing automation solutions and services tailored to their specific requirements, companies can achieve operational efficiencies, improve cash flow management, and mitigate risks associated with manual processes. As the market continues to evolve and expand, collaboration among key players and a focus on technological innovation will be essential for driving sustainable growth and delivering value to customers across industries.The Spain accounts receivable automation market is experiencing significant growth driven by the increasing demand for streamlining financial operations and enhancing cash flow efficiency. The segmentation of the market based on components, enterprise size, and deployment type provides a clear understanding of the diverse offerings available to businesses in Spain. With solutions encompassing audit management, credit management, collections management, and dispute management, companies have access to tailored approaches for managing their accounts receivable processes efficiently. Additionally, the availability of services such as professional services and managed services ensures that businesses receive the necessary support to implement automation effectively.

Furthermore, the market segmentation based on enterprise size highlights the growing adoption of accounts receivable automation among SMEs, driven by the need for operational streamlining and error reduction. As smaller enterprises recognize the benefits of automation in enhancing financial processes, the demand for specialized solutions and services is set to increase, propelling market growth further. The preference for cloud-based deployments signals a shift towards scalable, flexible, and cost-effective solutions in the accounts receivable automation market, reflecting a broader industry trend towards digital transformation and operational agility.

The presence of key market players like HighRadius Corporation, Sage Intacct, Inc., and FinancialForce underscores a competitive landscape focused on innovation and strategic partnerships. These companies are continuously investing in research and development to enhance their offerings, stay abreast of market trends, and meet the evolving needs of customers in Spain. Advancements in technologies like artificial intelligence and machine learning are playing a crucial role in reshaping how accounts receivable automation is approached and implemented, driving further market expansion.

Overall, the Spain accounts receivable automation market presents opportunities for businesses to optimize financial processes, improve cash flow management, and mitigate risks associated with manual operations. By leveraging tailored automation solutions and services, companies can achieve operational efficiencies and drive growth in a competitive marketplace. Collaboration among key market players and a focus on technological innovation will be vital for sustaining market growth and delivering value to customers across diverse industries in Spain.

The Spain Accounts Receivable Automation Market is highly fragmented, featuring intense competition among both global and regional players striving for market share. To explore how global trends are shaping the future of the top 10 companies in the keyword market.

Learn More Now: https://www.databridgemarketresearch.com/reports/spain-accounts-receivable-automation-market/companies

DBMR Nucleus: Powering Insights, Strategy & Growth

DBMR Nucleus is a dynamic, AI-powered business intelligence platform designed to revolutionize the way organizations access and interpret market data. Developed by Data Bridge Market Research, Nucleus integrates cutting-edge analytics with intuitive dashboards to deliver real-time insights across industries. From tracking market trends and competitive landscapes to uncovering growth opportunities, the platform enables strategic decision-making backed by data-driven evidence. Whether you're a startup or an enterprise, DBMR Nucleus equips you with the tools to stay ahead of the curve and fuel long-term success.

What insights readers can gather from the Spain Accounts Receivable Automation Market report?

- Learn the behavior pattern of every Spain Accounts Receivable Automation Market -product launches, expansions, collaborations and acquisitions in the market currently.

- Examine and study the progress outlook of the global Spain Accounts Receivable Automation Market landscape, which includes, revenue, production & consumption and historical & forecast.

- Understand important drivers, restraints, opportunities and trends (DROT Analysis).

- Important trends, such as carbon footprint, R&D developments, prototype technologies, and globalization.

Browse More Reports:

Global Lactose Intolerance Treatment Market

Global Active Metal Brazed (AMB) Ceramic Substrate Market

Global Treasury Software Market

Global Light-Emitting Diode (LED) Digital Signage Market

Middle East and Africa Active, Smart and Intelligent Packaging Market

Global Cardiac AI Monitoring and Diagnostics Market

Global Progressive Supranuclear Palsy (PSP) Treatment Market

Asia-Pacific Analytical Laboratory Services Market

Global E-Lan Metro Ethernet Services Market

Asia-Pacific Identity Verification Market

Global Biological Wastewater Treatment Market

Global Automotive Maintenance System Market

Global Healthcare Analytics Market

Global Candy Market

Global Biomanufacturing Viral Detection and Quantification Market

Global Optical Player Tracking System Market

North America Active, Smart and Intelligent Packaging Market

Global Kefir Market

Global Quantum Biotechnology Market

Asia-Pacific Rowing Machines Market

U.S. Anorexiants Market

Global Shockwave Therapy Market

Global Single-Cell Genome Sequencing-based Cancer Market

Global Industrial Bulk Chemical Packaging Market

Europe Automated Liquid Handling Market

Global E-Scooter/Moped and E-Motorcycle Market

Global Chemical Fungicides Market

Global Nystagmus Treatment Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com